What should a contractor do when the client refuses to pay?

You get the work in, you get the work out, you get the bill out … but you don’t get the money in. So now what?

Legally you’re probably in the right and your client in the wrong, and you have the legal right to commence a lawsuit, perhaps in conjunction with lien rights. Occasionally this works fine … occasionally. Typically, however, a lawsuit becomes an exercise in damage control, with the righteous recovery being lost to attorney fees, lost billable time and negative karma. And all too often, a fee action is countered with a professional negligence cross-complaint. To the uninitiated, a lawsuit is the first thought; to the sophisticated, the last.

Independent Contractor Classification (Dynamex Operations West)

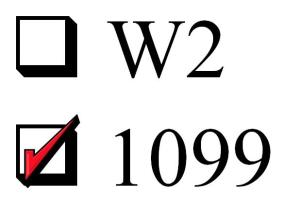

Does your business have independent contractors?

In April 2018, a landmark employment law case, Dynamex Operations West, Inc. v. Superior Court, was decided by the California Supreme Court.

Specifically, Dynamex deals with an employer’s ability to classify a worker as an independent contractor. Because of its importance, below is a brief outline with information that every business owner should be mindful of.

After Dynamex, can an employee ever again be classified as an “independent contractor”?

For years, businesses, workers, and the courts have struggled with the issue of when businesses may classify workers as “independent contractors” versus classifying them as “employees.” In April 2018, the California Supreme Court issued its landmark decision on this issue in Dynamex Operations West, Inc. v. Superior Court, 4 Cal. 5th 903 (2018). While the Dynamex court sought to clarify the law to be applied in this area once and for all, whether its goal of “clarity” was accomplished is subject to wide debate. What is certainly true, however, is that the Dynamex decision has vastly limited a business’s ability to classify a worker as an “independent contractor.”

New Laws Affecting California Employers

For California employers, January 1, 2017 marked the beginning of a five (or six) year upwards climb towards the new $15.00 state minimum wage.1 But that’s not all it marked. Of the 900 some new bills adopted into law over the 2016 year, many of them affect California employers and also went into effect on January 1st.