What should a contractor do when the client refuses to pay?

You get the work in, you get the work out, you get the bill out … but you don’t get the money in. So now what?

Legally you’re probably in the right and your client in the wrong, and you have the legal right to commence a lawsuit, perhaps in conjunction with lien rights. Occasionally this works fine … occasionally. Typically, however, a lawsuit becomes an exercise in damage control, with the righteous recovery being lost to attorney fees, lost billable time and negative karma. And all too often, a fee action is countered with a professional negligence cross-complaint. To the uninitiated, a lawsuit is the first thought; to the sophisticated, the last.

Independent Contractor Classification (Dynamex Operations West)

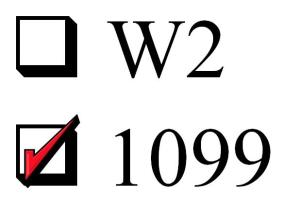

Does your business have independent contractors?

In April 2018, a landmark employment law case, Dynamex Operations West, Inc. v. Superior Court, was decided by the California Supreme Court.

Specifically, Dynamex deals with an employer’s ability to classify a worker as an independent contractor. Because of its importance, below is a brief outline with information that every business owner should be mindful of.

After Dynamex, can an employee ever again be classified as an “independent contractor”?

For years, businesses, workers, and the courts have struggled with the issue of when businesses may classify workers as “independent contractors” versus classifying them as “employees.” In April 2018, the California Supreme Court issued its landmark decision on this issue in Dynamex Operations West, Inc. v. Superior Court, 4 Cal. 5th 903 (2018). While the Dynamex court sought to clarify the law to be applied in this area once and for all, whether its goal of “clarity” was accomplished is subject to wide debate. What is certainly true, however, is that the Dynamex decision has vastly limited a business’s ability to classify a worker as an “independent contractor.”

California Labor Code § 218.7 (AB 1701): How does this new law impact general contractors, subcontractors and project owners?

On October 14, 2017, Assembly Bill (AB) 1701 was signed into law as California Labor Code § 218.7. This law imposes potentially significant liability on general contractors for their subcontractors’ failure to pay wages, fringe, or other benefits to laborers. The following is a brief overview of AB 1701’s application:

The “Completed and Accepted” Rule: Theoretical Considerations and Practical Tips

If you represent a construction professional who has been sued as a result of injuries sustained on a completed job, then you should be aware of California’s “completed and accepted” rule.

SB 496 And The Continuing Saga Of California A/E Firms’ Contractual Indemnification Risks

A significant, potentially firm-threatening, problem for every A/E firm is that governmental agencies and private owners seem compelled to use their superior bargaining power to require unlimited and uninsurable project risk allocation provisions in their professional services agreements.